I. Crisis of unequal distribution

II. EU under German hegemony

III. The only solution: dissolve the eurozone

IV. Breaking with casino capitalism

This catastrophic crisis is at the same time a great chance: in some of the most crisis-stricken countries the rule of the EU financial oligarchy might be toppled.

Trying to analyse the acute crisis of the last five years and the build-up that preceded it, we suggest a rough separation into two basic levels: a global momentum on one hand and a specific European one on the other hand. The latter is connected to the actual constitution of the EU and the economic predominance of Germany, combined with the political weakness of its elites. This configuration triggers a powerful amplification of the crisis, turning Europe into its centre – a crisis with the potential to bring down the entire system.

1. The basic tendency of the past three decades has been the systematic increase of distribution inequality not only between nations but also among the central states themselves (referred to often under the notions of neo-liberalism and globalisation). Thus scissors between possessing purchasing power and productive capacities are opening up. There are many ways to name this phenomenon depending on the school of thought you belong to and on which aspect to stress etc.: over-accumulation, under-consumption, savings glut…

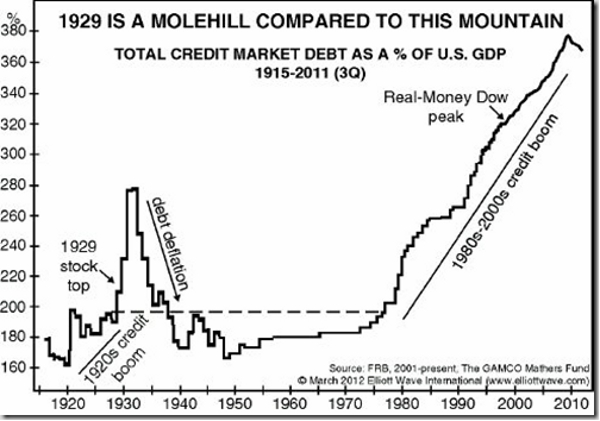

2. The other side of this phenomenon is accumulated capital which lacks possibilities for productive investment due to structurally weak demand.

3. Under these circumstances casino capitalism was born. Yield-searching capital is rushing into the speculative sphere – a movement systematically supported by the ruling system. The stock exchange fireworks start and property asset prices seem to increase without end. A giant credit bubble is inflated, several times the social product. This trend keeps pace like a Ponzi scheme as long as the return expectations remain high (not necessarily the returns themselves). Remember Ackermann, the CEO of Deutsche Bank, when reaching the climax of the flush, who proclaimed a rate of return on equity of 25%. That was spelled out in a general low interest rates environment reflecting the shortage of industrial investment occasions (saving gluts).

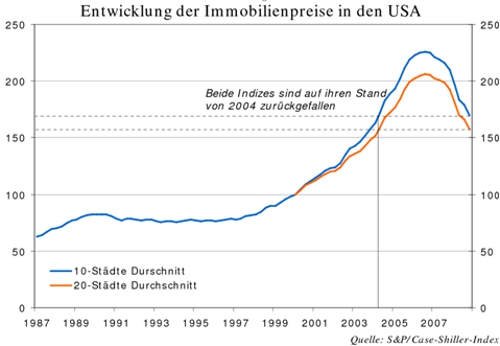

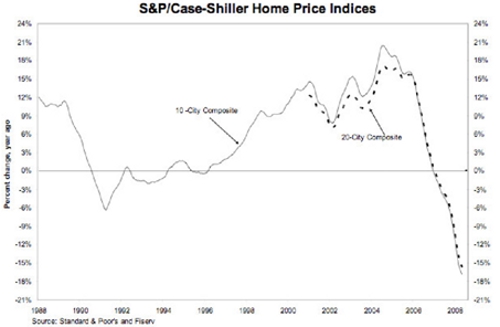

4. The credit boom provided for continuing consumption despite a potentially weak demand. The most instructive example is US subprime mortgages. Average middle-class people were virtually pushed into consumer credits secured by mortgages on their houses. Real-estate prices seemed to soar irreversibly, adding fuel to the economic cycle. Mortgage-backed securities found investors across the globe.

5. But the turning point came. Risk talking turned into prudence followed by panic. The Ponze scheme collapsed. (The speculator-cum-fraudster Madoff can serve as a typical image of the stock-exchange milieu.) Lehman Brothers collapsed, dragging further banks into default. Millions of people suffered foreclosures. In 2007/08 the bubble was perforated, but governments rushed in to patch up the holes to prevent the implosion. If mainly Washington had not reacted swiftly, the event could have resulted in a global collapse. The subprime bailout alone (which is difficult to separate from the other measures) amounted to some 700bn dollars, roughly 5% of GDP.

[US real-estate prices – further downward potential]

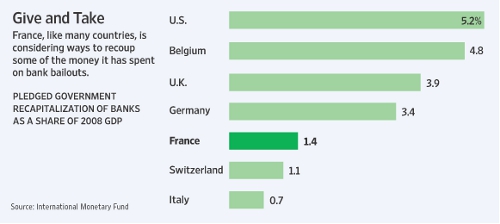

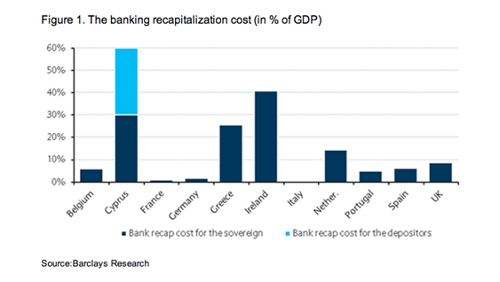

The excessive claims by the creditors (the other side of the debt) were reduced. The main effect of a capitalist crisis, the massive destruction of capital curbing these claims, did not yet take place. Financial capital was saved from default by guarantees and direct capital transfers by governments. Private risk, which had been officially supported and fomented, was eventually taken over by the state according to the motto: “Privatize profits, nationalize losses.” (One striking example is Credit Default Swaps or CDS). It is an insurance against default of sovereign bonds. However, the insurer is not obliged to hold an equity ratio for the case of a credit event. The business model is convincing: you take the premium but in the event of damage you are unable to pay – and turn to the state for rescue.) The amount of transfer to financial capital is differing from country to county and depends on the calculation as well. It is fair to assume that for the US it is about 10% of the GDP. These emergency measures led to a qualitative increase in sovereign debt thus building up pressure for austerity.

[The cost of the bailouts is great but does not hit the benchmark of the New Deal.]

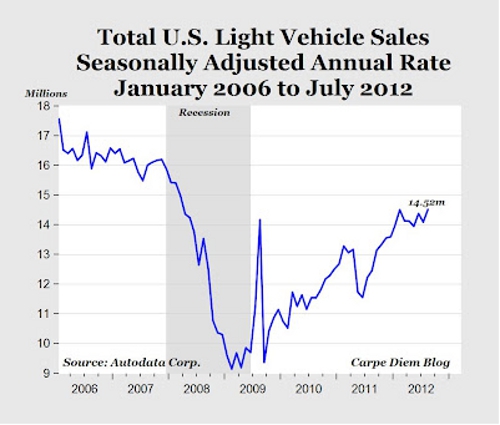

Subsequently consumption decreased but did not plummet as it would have without state interference. The US current-account deficit was halved to 2-3% of GDP, but the world economy still depends on US demand.

[The peak of 2009 was caused by the Cash for Clunkers programme.]

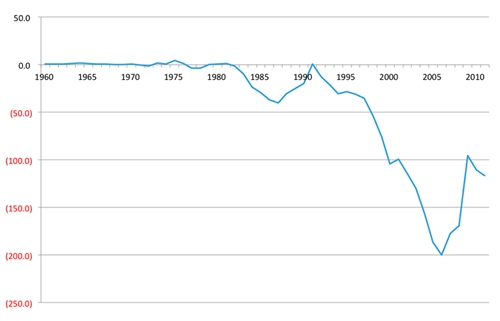

[US current account]

6. Monetary policy is the other front of emergency measures. The Federal Reserve slashed the interest rate to nearly 0%, lending money to the banks virtually for free. Additionally the Fed is running its third government bond purchasing programme called Quantitative Easing (QE) flooding the capital markets with liquidity. Its amount can be estimated at about 5-10% of GDP. There are many voices especially from German orthodoxy warning of the inflationary consequences. But money devaluation does not come about. One reason for that fact is that the banks do not inject the money into the real economy. On one hand they are risk-averse with regard to lending. On the other hand enterprises do not invest and therefore credit demand is low. But the money actually does flow into a new speculative bubble.

They write about a US recovery, talk about re-industrialization, envy dwindling energy costs, only to eventually admit that the US economy remains stagnant. Some observers even opine that QE is just enough to avoid deflationary contraction.

The US enjoy the “exorbitant privilege” to issue the global reserve currency. They can devalue their liabilities to the detriment of their creditors. In no other place monetization of debt works better than in the US. Though the value of the dollar tends to decrease, US treasury bonds are still the safest investment. Any other sovereign would face capital flight and would be forced to raise interest rates. Washington, however, continues to get credit for free.

***

On many occasions US policy was called Keynesian – a very bad name in the eyes of German ordoliberals. But this at best applies to monetary policy. Although there is no clear definition as to what Keynesianism exactly means, it is clear that at its heart lies stimulus by state demand. During the New Deal demand was created by top-down redistribution, financing government spending. Today official policies are all about defending unequal wealth distribution. The problem: wealth accumulated at the top of society is not being converted to the same extent into consumer demand as it would be at the bottom. And: nobody talks of increasing state expenditure. The debate revolves only around the amount of cuts.

Regarding the medium-term reaction to the slump, differences appear between the US and Europe and especially Germany as its leading power. There are several reasons. The most obvious is that the EU is not a single state as opposed to the US. It is not a question of economic inhomogeneity as the US features striking internal differences as well. It is all about political power. Berlin refuses to assume financial responsibility for the member states while it is imposing its economic policy on them. The discrepancy between economic power on one hand and political egoism and myopia on the other hand does not sufficiently explain German policies. The dogmatic fixation on monetary stability is globally unique, an idiosyncratic aspect.

Let’s have a closer look on this policy that is pushing the EU towards the abyss. The eurozone was built along the parameters of German economic and monetary policy. Like the Bundesbank also the ECB does not abide by the will of the sovereign, but reports exclusively to the financial oligarchy. Its one and only target for more than half a century has been monetary stability.

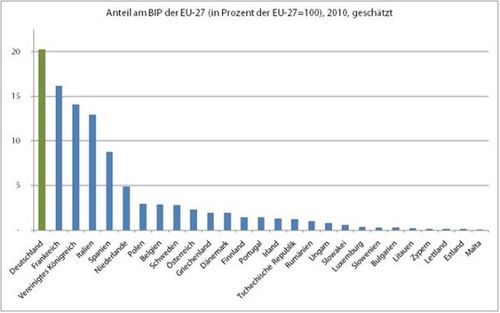

In order to impose this target on the currency zone – within which Germany is only primus inter pares, representing a mere quarter of the zone’s GDP – the Maastricht treaty 1992 prescribed permanent austerity. Public debt must not exceed 60%, while annual government deficit must not surpass 3% of GDP. Interest rates are to be fixed in order to keep inflation low even at the expense of hampering investment activity.

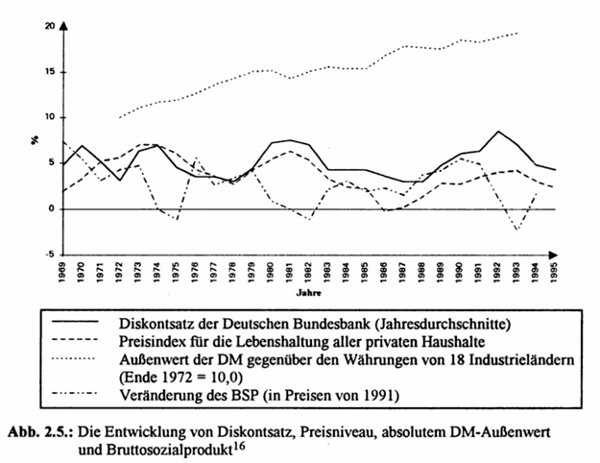

Indicatively, the precursor of the Euro, the European Monetary System (EMS), collapsed the very same year, due to German intransigence. The exchange rates of the European currencies had been fixed against one another within a narrow floating band range of 2.25%. For fear of inflation after the German post-reunification boom, the Bundesbank had boosted the prime interest rate. Consequently capital flowed from the peripheral states to Germany. The periphery had to react with even higher interest rates, pushing financing costs to unsustainable highs and thus strangulating economic activity.

[German prime interest rate – continuous line]

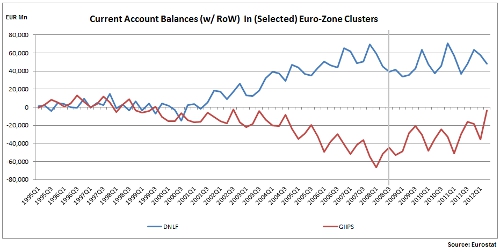

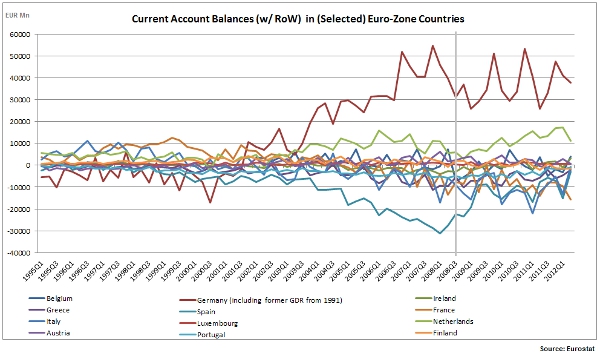

Europe was pushed into recession and the pressure on the periphery to devaluate was rising. Eventually the EMS peg relations collapsed and many currencies devaluated. The floating band range then had to be fixed to 15%. At that time it was Germany to pay a higher price with a decade of recession. Meanwhile the periphery was able to achieve higher growth rates. The current accounts remained more or less in balance. The industrial states France and Italy proved even able to secure surpluses. The huge imbalances of the 2000s have exploded with the establishment of the common currency, a much radicalized EMS.

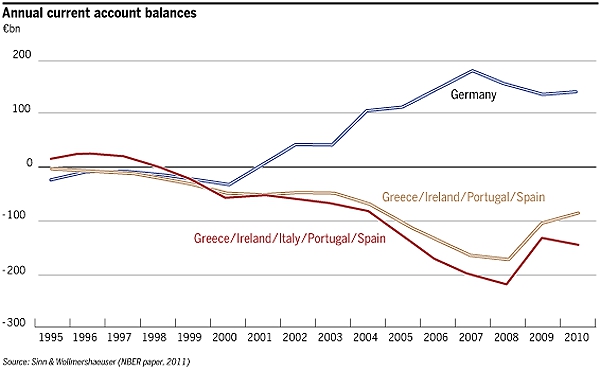

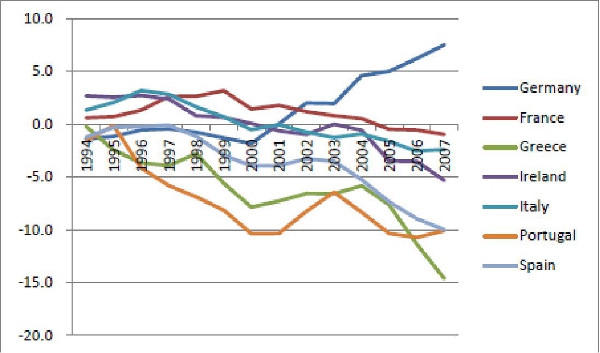

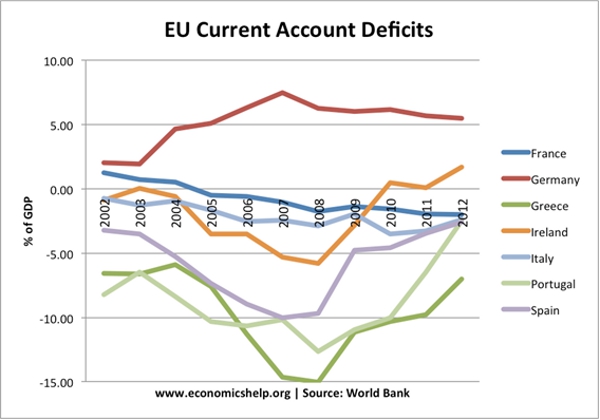

[During the 1990ies current accounts between north and south Europe were pretty much balanced. It was the Euro that rapidly lead to the tilt.]

[Displayed in absolute figures the weight of Germany on one side and of Spain on the other is depicted.]

[After the break-up of the EMS, industrialised Italy was able to achieve surpluses. With the Euro, Italy’s deficit grew at a faster pace than that of the other deficit states.]

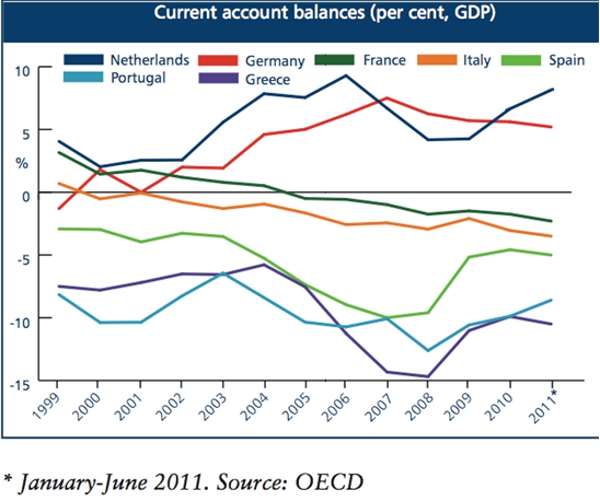

[Relative figures show that the smaller Netherlands run the same policy like Germany. One can see the structural difference between France/Italy on one hand and Spain/Portugal/Greece as well as Ireland. The latter was able to achieve the turn-around according the financial elites requirements.]

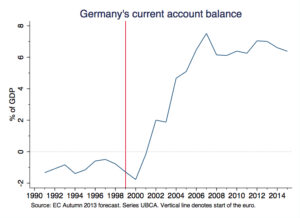

After its introduction the Euro seemed to be a sweeping success. The disadvantages of weak currencies, to be obliged to pay higher interests on the capital market, evaporated. The result was a tremendous credit bubble, larger than the one which would have to be expected without the specific circumstances of a common currency. First of all the private and corporate sectors produced a boom of consumption and property asset prices exemplified by the Spanish real estate bonanza. Unit labour costs were pushed up by general price increases while not matching productivity increases achieved by the centre. Germany meanwhile had embarked on a wage deflation policy (Agenda 2010, Hartz IV). The current accounts not only of the extreme periphery like Greece or Portugal but also of the semi-centre like Italy or France turned negative to an unprecedented extent. A tilt came into being which was neither made visible by the Maastricht criteria nor averted by matching them. On the contrary, Germany was celebrating its “economic miracle”. Surpluses of up to 7% of the GDP were read as signs of strength and not as an acute symptom of crisis. As long as surplus capital flowed back to the periphery as credits offsetting the deficits, this could continue.

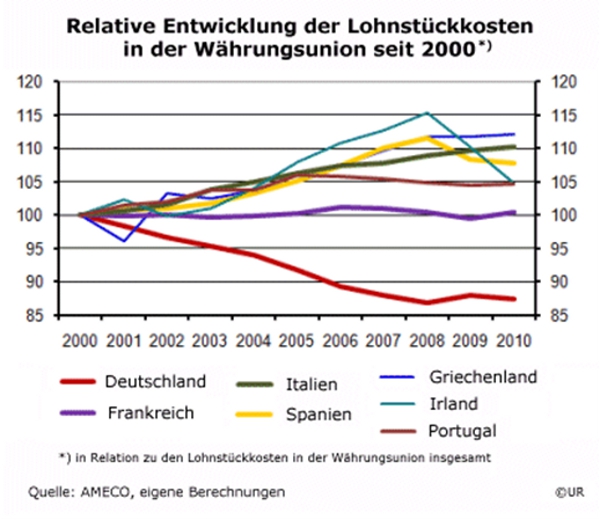

[Labour unit costs: sweeping change in Ireland by austerity.]

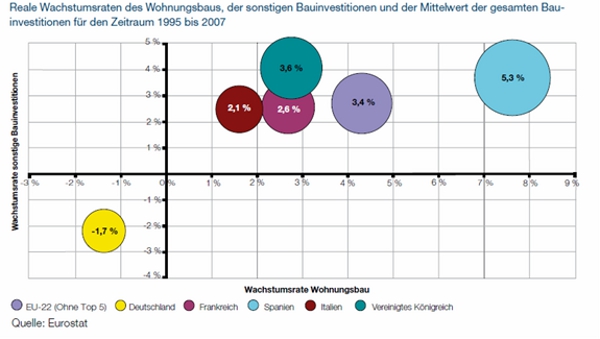

[Real growth rate of investment in construction.]

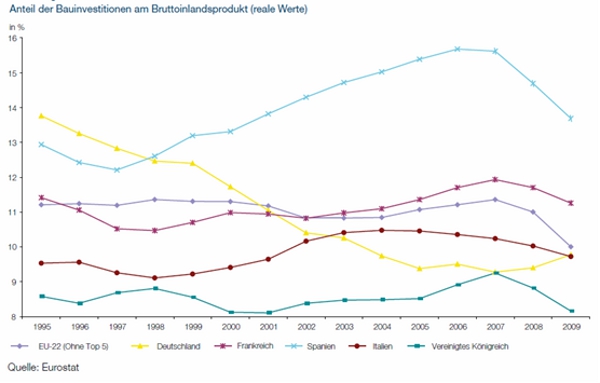

[GDP ratio of construction: Spanish and German anomaly.]

Current account deficits are a dangerous thing except for central economies. Only currency reserve countries can afford them for a longer period without damage. As US liabilities exclusively denominate in their own currency, which additionally have been for free for several years already, they don’t risk much. To a lesser extent this is also true for Britain. Put differently: The US (and Britain) economies are able to force the rest of the world to lend them capital on US (or British) terms. (Whether this can go on forever is another question.) For all other capitalist economies, which predominantly borrow in foreign currency or which have to pay high interests, permanent capital import (by definition necessary to cover current account deficits) is a recipe for crash. When the cycle is drawing to a close or the credit bubble is bursting, their currencies come under pressure. Either they defend their currency by raising interests, extinguishing economic activity, or they eventually decide to devaluate, forcing the foreign currency debtors into default. Therefore most peripheral economies try to run current account surpluses. From this fact stems the capacity of the US & Co to finance themselves on advantageous conditions (also called savings glut). Globalisation leads to the reversal of the old principle of the British Empire and also earlier US dominance according to which capital is exported from the centre to the periphery. Martin Wolf of the Financial Times comments this strange inversion as following: “Capital now flows upstream, from the world’s poor to the richest country of all.” [fn]Wolf, Martin, Fixing Global Finance, 2010, p. 59.[/fn]

This mechanism did not operate within the eurozone or came into effect rather late, due to the common currency. Only with the burst of the global credit bubble, financial capital went into panic mode and tried to escape the eurozone’s south. Interest rates exploded. Despite of the Euro the old interest spread reappeared but with a much higher debt exposure first of all in the non-state sectors. By the bailouts the costs were turned over to the public household driven by the central idea to save the banks of the centre.

It is important to note that sovereign debt is neither the reason nor the central theatre of the crisis, but only one phenomenon. The obsession concerning state debt, which has been raging since Maastricht, distracts from the systemic reasons of the crisis and implies radical cuts in state expenditure as main remedy.

The first reaction of the German elites was to refuse risk-sharing for the common currency and therefore for all the eurozone economies. The oft-quoted Eurobonds would have ended the aspect of capital market panic which has been ravaging the periphery, would have diminished the interest spreads, would have removed sovereign debt from the centre stage and thus would have softened austerity. For sure Eurobonds could not have solved the crisis, but at least they could have helped to deal with it on the same level as in the US or in Japan. But the German financial oligarchy did not want to give up a whip by which they can enforce austerity and domestic devaluation. They want to save their banks, their capital, and make sure that their debts are served. But that meant also that in the last moment before insolvency, they nevertheless stepped in, also because their Anglo-Saxon partners wanted them to do so. Under the troika, a system of emergency credits was created (ESEF and ESM) which are bound to the notorious IMF conditions. For Greece even “haircuts” were implemented although they very much favoured private creditors. In Cyprus even private depositors were partially held accountable, also because they to a large extent did not belong to the German-centred oligarchy.

The austerity programmes aim at so-called “inner devaluation”. They should do the same thing as currency devaluation would do, namely to re-establish competitiveness of export industries by adjusting the exchange rate. But there are important differences: Devaluating the currency impoverishes the entire society with the exception of those holding assets in foreign currencies. Wages, rents, debts, assets etc. maintain their relations among themselves while they change their value in relation to other currencies. This is not only socially more balanced but also supports the domestic industry as foreign products are pushed out of market as their prices increase. Meanwhile the inner devaluation first of all targets the subaltern classes and affects the upper strata of society only in a more mediated way. Wages and transfer payments decrease; debt and interest initially keep their level and fall only with the ensuing recessive spiral.

Can such a programme achieve success? Maybe it can work for small economies with certain preconditions like Ireland: If the production costs are slashed until competitiveness is reached, if the population accepts social decline, then the products might be sold on the world market without changing much the total relations as the share of a small economy of the global GDP is negligible.

This does not apply to the large southern European economies. First of all the population will not accept slashing living standards by a third to half without resistance. Already by now the old political system is hardly functional enough to impose the elite’s programme. In addition there is no space for large exporters on the world market. If all European economies simultaneously reduce their internal consumption across all sectors (state, corporate, households) and embark on export for growth, a strong contraction must follow as total demand collapses. Historically Europe is trading predominately among itself while the aggregated current account with the rest of the world was more or less balanced. As spender of last resort the US is saturated.

Is there a way out for the eurozone under the rule of the financial oligarchy? The construction of a common European state can fortunately be excluded even if some “leftist” intellectuals are swaggering about that nightmare. The oligarchy was not even able to establish the banking union which would mean that Germany exchanged guarantees with control. The line chosen by the German elites and dictated to the rest of Europe leads into a catastrophic recession which sooner or later will also affect the centre. Given the crisis-stricken global economic environment there is no place for Europe as an export surplus centre which would add to the already huge global imbalances.

Germany’s economic policy borders the absurd if one touches fiscal policy. They run a current account surplus of some 5% of the GDP, lending is virtually for free – they float on an ocean of unused capital – but Berlin nevertheless is striving for zero deficit and maintains wage deflation. They are anxious for their competitiveness – a point that observers educated by the neo-classical mainstream might deem plausible. Alone by invoking social justice one could argue that this 5% surplus is nothing less than unpaid wages and needs to be transferred to working people. If they turned entirely into consumption, they would provide a stimulus for the German and European economies. But growth develops an inductive impact fuelling the capitalist cycle. Investment grows and so does labour productivity. Hence competitiveness does not automatically decline when wages are increased.

Berlin sticks to its anorexic line while even the IMF expressed some doubts. Unabated recession will deepen the debt crisis of all sectors and eventually lead to defaults of larger states as well. For the time being at the very last moment the troika stepped in, though Berlin had rejected to do so. Emergency measures always revolve around the following elements: share risk and extend guarantees, haircuts including controlled creditors involvement, softening austerity.

It is possible that Berlin, with its back to the wall, will make some concessions here and there. But it does not look as if such concessions were sufficient to save the eurozone from breaking apart. Not only the elite and its ordoliberal ideologues will continue to veto bold emergency measures, but there is a powerful voice of the German middle classes who simply “do not want to pay for the lazy south”. In contrast to the elites, they are not aware that the entire set-up of the eurozone favours German business. They do not care if the entire project of the euro and the EU fails, as they lack imperial ambitions.

The German elites are destroying the eurozone and heavily damaging the EU by provoking the most severe European crisis since WWII. They are incapable of regional let alone global dominance – and that’s fine. They lost two wars and now fail once again to unify Europe under their leadership. It is not difficult to foresee that Europe will politically be turned upside down.

In the most hit European south popular resistance is rising. Especially in Greece and Italy the current political systems are wearing themselves down by imposing the interests of the European financial oligarchy. In both countries the old elites have lost electoral consensus.

In Athens parliamentary democracy has been step by step suspended and substituted by a coercive troika administration. The main opposition party Syriza has at least partially an anti-systemic momentum. Although the euro was declared untouchable even by Syriza, this last taboo is being dismantled. On the other hand Nea Demokratia as the representative of the Berlin programme could stabilise itself around the old elites and part of what remains of the middle classes.

Also in Italy, which is much more central, the situation is boiling. Different to Greece even sections of the upper classes question Berlin’s and the troika’s dictates. The latters’ direct servants were reduced to a third of the electorate. Grillo represents the hope and will for a deep rupture with the old system and does not only rally the poor but also some entrepreneurs hit by the crisis. Then there is the clown Berlusconi who knows how to play with the sentiment against the European oligarchy. Without substantial concessions by Berlin, the Letta government will not last very long. But Berlin underestimates the danger with a mixture of arrogance and narrow-mindedness and maintains the pressure on Rome.

Also in Portugal and Spain resentment and unrest against the rulers are growing but politically less articulated. Therefore the political systems are not endangered in the same way. Give the depth of the social crisis, political changes can be swift and sweeping, arising virtually from nothing.

In the south the idea of leaving the euro is suggesting itself more and more as the social massacre is conducted in its name. Around this demand all ideas are crystallizing how to stop the disaster. Yet they are not fully formulated. Around the slogan of leaving the euro, different social interests can converge which renders it suitable as the base for a broad popular alliance. Conflicts will be, however, inevitable.

Italy has been an important industrial power which was severely weakened by the euro. While entrepreneurship used to be politically weak, sociologically speaking is it broad. Also there the idea to leave the euro is spreading. Italians want to deliver a strong signal of protest to the troika and Berlin. The re-establishment of a devaluated lira would increase the prices for foreign products and eventually create demand for the flagging Italian industry. The sharp austerity requirements could be tuned down and a stimulus emitted by fresh state demand. Actually a very moderate Keynesian programme.

Probably an exit from the euro would be followed by state insolvency as capital would try to escape pushing interest rates up. But especially Italy got the advantage that its debt is mainly domestic which makes a haircut and the transformation into lira-denominated titles easier and hinders the tendency to flight. Faced with such a fait accompli the international financial oligarchy would try to avoid a full-fledged default and might agree to a debt restructuring hoping to limit the shock waves emitted to the global system.

Such a step could attract a part of the elites, partly because it promises a solution to the political leadership crisis of the country. Whoever endeavours such an audacious move needs and will gather the support of the majority.

In Germany and other centre states the political situation is totally different. The left opposite against the wage deflation line (Hartz IV) is exhausted. A Keynesian programme is cannot rally majority support. The newly acquired hegemonic role of Germany (which by no means was so clear even half a decade ago) entailed a political shift beneficial for the elites. If there is a vocal opposition against Merkel’s line it is spearheaded by the “Swabian housewife” against the guarantees, emergency loans and expansionary monetary policy (for example Hans-Werner Sinn, an economics professor). It includes a hefty dose of social chauvinism against the south. They do not actively call for the dissolution of the Eurozone, but it would be nevertheless the consequence of their approach. Meanwhile the “Alternative for Germany” is openly campaigning for giving up the euro. They developed considerable pressure on the Merkel line and thus render future bailout measures politically more and more costly for the CDU.

The task in Germany is to lend a voice to the southern European opposition as a campaign for the dissolution of the eurozone. The philistine opposition against the Euro is certainly the minor evil in comparison to Merkel, Ackermann and Asmussen. An involvement of Germany in ending the eurozone would also offer the advantage that the popular anger at the crisis that eventually is going to hit also Germany would be directed more against the own elites and not so much against the south.

In southern Europe, and especially in Italy, a kind of “popular front” across classes against the dictate of the troika seems possible. The programme could be summarized as a national, productive capitalism with Keynesian governance in contrast to global casino capitalism.

Is this possible? As there are no significant anti-capitalist forces, it seems to be the one and only possibility. Still, huge and powerful popular mobilisations and struggles will be necessary in order to enforce the break with the old regime. The chunks of the elites and the capitalist elements who sympathise with a Keynesian programme nevertheless will try to maintain their links with the old regime, will soften the onslaught and will try to keep the tremor small. They on their own are unable to move ahead and deliver the decisive blow to the oligarchy.

But the crux with Keynesianism is that it can only work as long as the capitalist elites keep the reins in their hands (see the New Deal or the European “Economic Miracle”). A certain mobilisation from below to display to the elites the costs of the alternative will certainly not harm a Keynesian project. On the contrary it is even necessary. But as soon as the elites seriously fear to lose control altogether, things turn different. Capital will try to escape, depriving society of decisive resources.

As such a point approaches measures will become necessary which will bring deep changes in society and will cause fierce conflicts with the capitalist classes:

1. The first and immediate measure after having announced to leave the euro is to block capital flight. Capital transaction controls will be implement which even the EU oligarchy accepted in the case of Cyprus, in breach of their own rules.

2. The second step is a moratorium on debt with the readiness for restructuring (insolvency) but leaving the option of outright default open in front of the creditors of the international financial oligarchy. The condition for an agreement must be the end of the troika’s policy. The door to the capital market should be kept open but not at any price. The minimum requirement is the Keynesian programme devised before. Domestic creditors need to be treated preferentially to keep them within the country (see Argentina).

3. The central bank must be brought under the political control of the sovereign, the people, and issue a new national currency. Its stability remains an important goal, but not the exclusive one. Monetary policy must be subordinated to a comprehensive economic policy. (A situation like in Argentina with the dollar as de-facto or substitute currency is to be avoided.)

4. Insolvent banks are sent into bankruptcy and recapitalised by the state who will take control. The capital market must be regulated, derivatives and financial speculation should be outlawed.

5. The state arranges a programme of reconstruction and development to be controlled but not exclusively implemented by him. On one hand there is the aspect of strengthening demand by increasing the wage ratio and by public investment in all sectors benefiting the people: housing, infrastructure, public transport, education, health etc. This could bring into motion a cycle reviving industry both in the sector of consumer as well as investment goods.

6. Complete nationalisation is to be avoided and should be considered as measure of last resort. Necessary capital should be raised by progressive taxation. Issuance of government bonds should, however, not be excluded if such an operation is feasible with reasonable interests. In case of acute need also compulsory loans could be used. The state as a creditor will have to support all projects deemed useful for the people and its economy by favourable interest rates.

7. On foreign trade: The concept of autarky failed. It remains useful to develop and maintain an internationally competitive export sector in order to be able to purchase international products. This entails to permanently increase labour productivity. It also means to care for a balanced current account to avoid dependence on international capital – this balance will anyway be imposed by high interest rates and most probable also for political reasons. Free international trade, however, always serves the strongest players. Many sectors of peripheral economies need to be protected by levying customs duties. This is a means of economic control. Capital transactions need to remain under state control including the trade with all types of securities and foreign exchange.

8. Monetary policy is an important aspect of overall economic policy. If an economy wants to take part in the global division of labour (even if moderated and controlled) and consequently participate in global trade some rules set by the strongest must be observed – unless one establishes foreign trade monopoly as the Comecon had instituted. As long as the economy is capitalist capital remains mobile despite all political constraints imposed. A reasonable balance between currency stability and money supply must be striven for. Increased money supply can have an inductive impact as a form of politically controlled capital allocation. Inflation and devaluation sometimes might be the lesser evil but it should not be forgotten that it means impoverishment and leads to higher interest rates. (The interest spread can be read as a measurement for capital flight.)

9. Last but not least: we should give up the capitalist consumerist model of development. The crisis should be used as an occasion to create space for the widespread exigency to create an alternative. Development goals cannot only consist in increasing material consumption and technical progress, but they should be about comprehensive human development, work and leisure as self-realisation (in lieu of the dichotomy between compulsion and consumption), live in tune with nature, support to communities and their cultures and the active democratic participation in politics and the formation of society. Solidarity with the weaker in one’s own society and globally need to acquire much more importance. This should neither be confused with denial of material needs nor be forced upon somebody. It is an offer, a choice which did not exist so far.

We are not talking about an anti-capitalist project, but only a programme of radical break with the ruling financial oligarchy in favour of a national, democratically controlled capitalism. It seems possible that a majority of the people can gather around such a programme even including some elements of the capitalist classes at least for a certain period. Overcoming capitalism has been proved historically a protracted and difficult endeavour requiring strong and broad popular consensus. The fact that the ancien régime of casino capitalism has lost credit does not mean that people strive for a (new) socialism. Historical wounds are too deep. Hopefully such a project can be developed while fighting for a kind of “popular capitalism”. But this is a future task. The current task is to topple the financial oligarchy at least in some places, to seize power from them – a task large enough.

May 2013